Whistleblowing reporting systems

We help with implementation and processing!

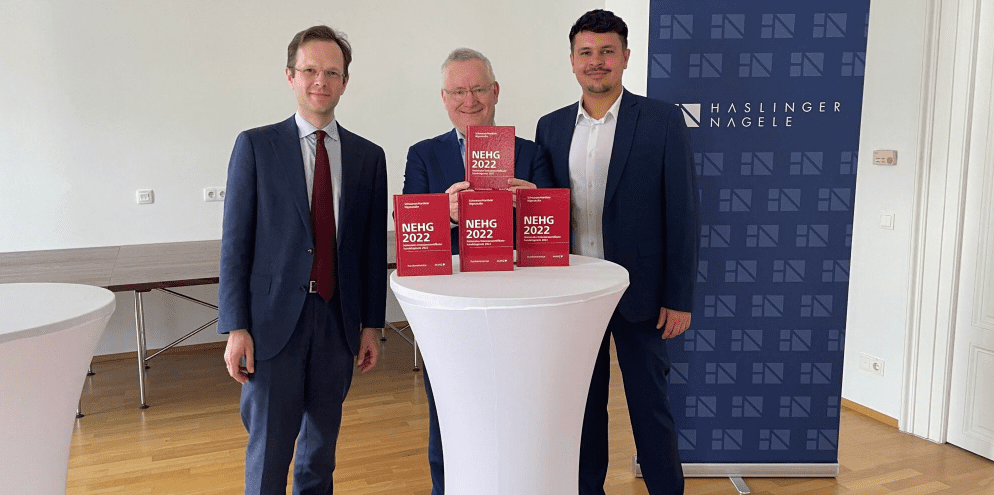

Now available on retailers’ shelves and also in the legal database (rdb.at): The first legal commentary on the National Emissions Certificate Trading Act (NEHG), written by Univ.-Doz. Dr. Mag. Stephan Schwarzer (Institute of Austrian and European Public Law at the Vienna University of Economics and Business), Attorney-at-Law Dr. Johannes Hartlieb, BSc and legal trainee Mag. Emil Nigmatullin (both Haslinger / Nagele Rechtanwälte GmbH).

The national emissions trading scheme (known as the CO2 tax) covers all companies and consumers that do not fall under the European emissions trading scheme and use fossil fuels. These are essentially all smaller industrial plants, traders, transport and other service companies and households, which means that the new law will have a considerable broad impact. Those companies that place the fossil fuels on the market, e.g. producers, importers, energy traders and gas stations, are obliged to pay the levy. These obligated companies (trading participants) then charge their customers a higher price for the fossil fuels. This makes the new levy a steering instrument.

“Almost all companies and consumers that use fossil fuels are affected by the new CO2 tax. The new legal commentary helps all those affected to understand the complex provisions and to claim relief.”

Univ. Prof. Dr. Mag. Stephan Schwarzer

The new work offers an introduction to the development, focus, main contents and fundamental questions of the law. In addition, the commentary develops the law further where it lacks answers and focuses on questions of legal protection and exemptions in the light of the steering purpose. Last but not least, ways of recovering levy payments in cases of hardship and due to the risk of emigration are examined, with the lack of implementation rules becoming more problematic from quarter to quarter.

8. May 2023